Indian Bank is planning to retain more or less the same double-digit growth targets in terms of deposits and advances during FY25, said a top official.

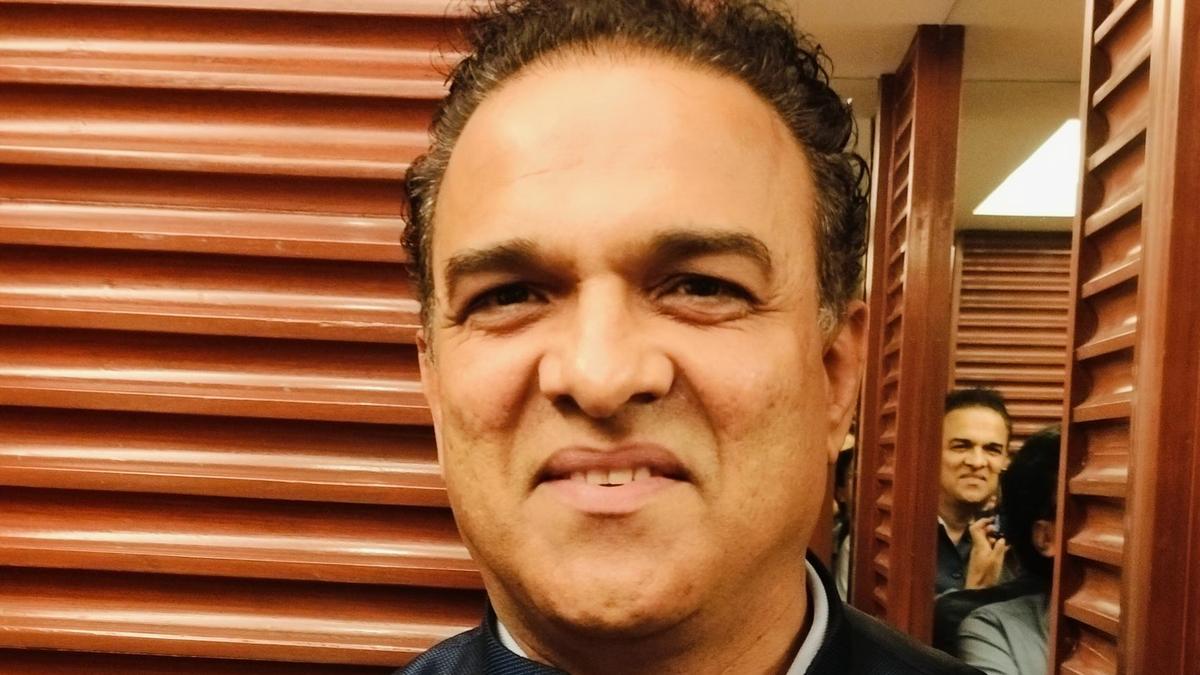

“Last fiscal, we set a deposit target of 8-10% and achieved 11%. Credit-growth target was kept at 10-12%, whereas we did 13%,” said MD and CEO S.L. Jain during a press meet.

For FY25, the public sector lender has pegged the deposits growth at 8-10% and credit growth in the region of 11-13%. “We want to keep the growth target small and achieve it,” he said.

Stating Q1/FY25 business had been usual despite elections, he said the lender was continuing to get enquiries for credit from sectors such as renewable energy, solar panel, ethanol, food processing, e-commerce, city gas distribution, smart city projects, data centres, warehousing, infrastructure and power.

According to him, Retail, Agriculture and MSME (RAM) sector’s contribution to gross domestic advances will increase to 63% from 62% and corporate advances to 37%. The bank plans to have a broad-based portfolio so that the risk is spread evenly across sectors. Currently, it does not have any slippages in the corporate advances segment.

Mr. Jain noted the merger of Allahabad Bank with Indian Bank had been positive. There has been a substantial jump in net profit every year since FY21 from ₹3,005 crore to ₹8,063 crore in FY24.

To a question about recovery of bad debts, he said, “Last year, we had set a target of ₹8,000 crore and recovered more than ₹8,799 crore. This year, too we plan to recover ₹8,000 crore. Cash recoveries are more than the slippages (₹6,635 crore) and it is not a cause for worry.”

On the digital initiatives, Executive Director Mahesh Kumar Bajaj said the transactions through ATMs, bunch-note acceptors and digital channels improved by 4% to 89%, while the digital business jumped to ₹81,250 crore (₹5,640 crore). They were hopeful of crossing ₹1,00,000 crore mark this year.

1 week ago

101

1 week ago

101